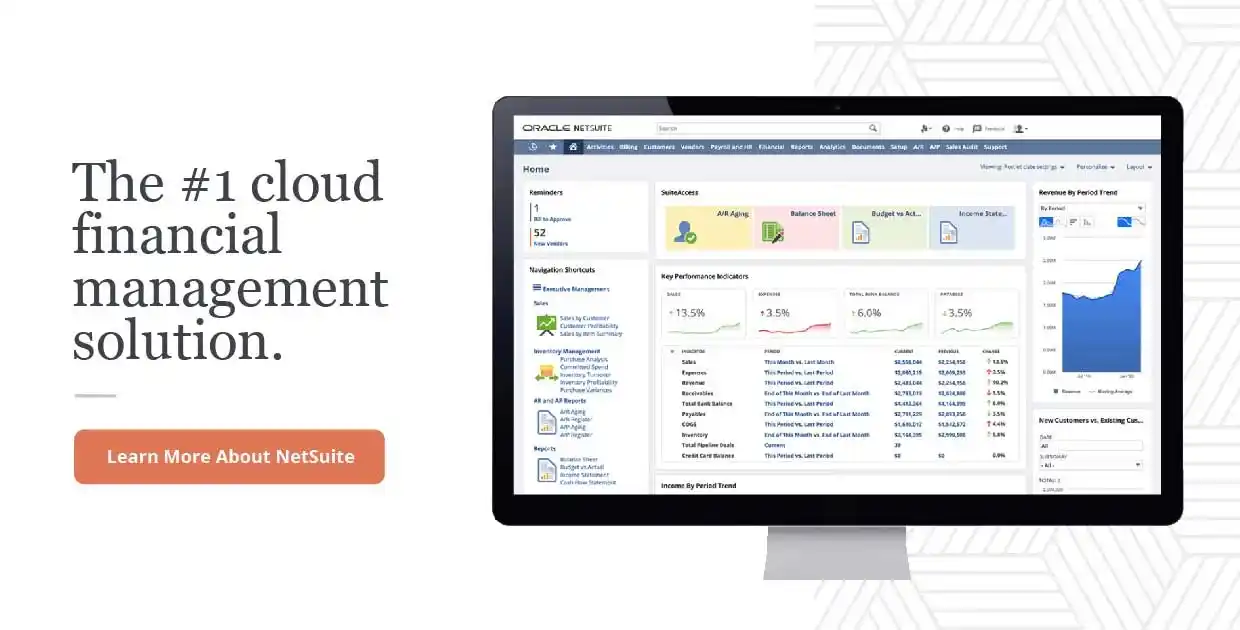

NetSuite Financial Software for Businesses

#1 ERP Accounting & Financial Management Software

NetSuite offers a powerful cloud-based financial management software solution that helps businesses effectively handle their financial operations. It encompasses a range of essential features such as accounting, financial reporting, budgeting, forecasting, and analytics. Businesses can easily manage tasks like tracking payments, invoicing customers, managing general ledger, and handling cash flow.

According to Gartner, by 2024 60% of organizations will consolidate core financial management with financial planning and analysis capabilities within the same vendor stack/platform.

Reach beyond traditional accounting software! NetSuite integrates seamlessly with your entire business order management, inventory management, CRM, eCommerce and more) for an end-to-end suite of products to foster a productivity-driven enterprise.

What Makes NetSuite One of the Best Financial Software Options?

NetSuite stands out as the top accounting solution because of its comprehensive suite of financial management tools that combine core accounting features with advanced functionalities like financial planning and forecasting. NetSuite provides scalability, accessibility, and cost savings for growing businesses of all sizes. Real-time reporting and analytics empower finance teams to make data-driven decisions, while automation streamlines workflows and improves efficiency. NetSuite's robust security measures ensure the protection of sensitive financial data, and its integration capabilities enable seamless connectivity with other business systems. Learn why NetSuite was recently named a top leader in SaaS and Cloud Finance in 2024

NetSuite has future-facing features for modern businesses that can:

Accelerate the order-to-cash process by 50%.

Accelerate the order-to-cash process by 50%. Slash financial close by over 50%.

Slash financial close by over 50%. Obtain daily cash balance visibility using up-to-the-minute comprehensive reporting.

Obtain daily cash balance visibility using up-to-the-minute comprehensive reporting. Enhance decision-making with personalized dashboards and real-time data.

Enhance decision-making with personalized dashboards and real-time data. Improve workforce productivity with anytime, anywhere access in the cloud.

Improve workforce productivity with anytime, anywhere access in the cloud. Eliminate upfront IT expenditures and deliver automatic product upgrades.

Eliminate upfront IT expenditures and deliver automatic product upgrades.

Businesses that have the right financial management tools in place are better positioned to grow and make data-informed decisions, no matter what comes their way. With the unpredictability of the economy, businesses are constantly being forced to adapt to stay afloat. As integrated financial planning and analysis continue to grow as a business focus in 2024, NetSuite’s financial management suite continues to rank at the top of Gartner’s Magic Quadrant amongst competitors.

5 Signs You're Outgrowing Your Accounting Software:

Do These Finance Challenges Sound Familiar?

1. Lack of controls or approvals on journal entries

2. Takes too long to close the books at period/year-end

3. Producing regular reports is manual, time-consuming and often requires Excel

4. Lack of real-time visibility into finances impedes decision making

5. Too many accounts required to operate business.

NetSuite Cloud Accounting Solutions & Advantages

• Use business rules to define when journal entries require approval

• Built-in period close process and checklist

• Robust, native reporting engine with many reports out of the box as well as the ability to create custom reports

• Cloud-based, single database, real-time system with proactive business alerts and KPIs

• Financial Segments can be used to reduce the number of accounts

• VAT reporting with online filing for various countries

What is Financial Management? Overview & Resources: Successful financial management helps a business budget and operate effectively to support long-term plans. Financial management boosts profitability, maintains cash flow, improves customer satisfaction, and more. Learn why NetSuite ERP is the leading solution of choice for inventory and order management, ecommerce, financials, and CRM.

NetSuite for Finance vs QuickBooks

NetSuite and QuickBooks what are the major differences? NetSuite's integrated system surpasses QuickBooks' focus on financials alone. By seamlessly integrating financial management with other essential business functions, NetSuite ensures data consistency, streamlines processes, and provides a unified view of operations. Its scalability and flexibility make it ideal for growing businesses, offering enhanced efficiency and visibility across the entire organization. In contrast, QuickBooks may have limitations in handling complex business requirements. Overall, NetSuite's integrated system empowers businesses with comprehensive management capabilities, making it the superior choice over QuickBooks' standalone financial approach. Outgrowing QuickBooks? Compare QuickBooks Accounting to Oracle NetSuite.

NetSuite Features:

NetSuite Accounts Payable

NetSuite Accounts Payable Features:

Streamline Critical Processes

Match your purchase orders, vendor invoices, and receipts with ease and speed. Eliminate efficiency-draining manual input and processing. NetSuite Accounts Payable helps finance professionals achieve visibility, accuracy, and efficiency.

- Record Entry and Check Printing

Populate check fields, schedule batch check prints, and prepare the mailing of payments automatically.

- Reporting

Create reports based on expense type, due date, payment date, payment period, payment status, internal source, and vendor. Map out which payments have been made, which have been made but have not yet cleared, and which have been processed.

- Master Vendor List

Track individual payments alongside an ongoing vendor database. This vendor list can consolidate data including contact info, addresses, and vendor terms. - Payment Planning

Making early payments can prove beneficial if there’s financial incentive. NetSuite AP helps you identify upcoming payments and the best timing in which to make them. - Purchase Order and Invoice Reconciliation

Identify payment authenticity by reconciling invoices and POs with corresponding AP entries. Associate payment records with the original POs and/or vendor bill helps to reduce errors and fraud. - 1099 Reporting (US)

Flag and create the paperwork for non-payroll payments to non-corporate entities to provide the right tax forms. - Integration

Integrate your PO module and master vendor list to benefit both your AP and PO processes. Easily identify payments that have been made and reconcile AP and bank records. - Advanced Reporting

Customize fields, report using complex instructions, and create graphical reports to improve your business’s overall efficiency.

NetSuite Accounts Payable Benefits:

- View all debits, credits, revenues, and costs within the same accounting period for more accurate profit and loss statements.

- Eliminate manual payment processing of loan, rent, and utility bills.

- Add custom data fields for unique business processes.

- Enhance purchase tracking, credit card use, and employee advances with detailed reporting.

- Take advantage of early-payment discounts from vendors.

- Fully automate check and payment processing for efficiency and cash management.

- Develop custom workflows according to business needs.

- Cut costs by managing your payables to avoid late-payment penalties.

NetSuite Accounts Receivable

NetSuite Accounts Receivable Features:

Make Smarter Business Decisions

NetSuite Accounts Receivable helps you manage customer credit and assure you’re paid on schedule. Since these payments fuel your business, properly recording, managing, and tracking your receivables is vital.

- Use a consistent master customer list to store detailed, individual customer records.

- Connect each receivables entry post with the appropriate customer in real time.

- Advanced sorting capabilities allow you to easily identify customers in good standing versus those with late payments.

- Quick, automated information updates help you make more informed, key business decisions.

- A reliable, ongoing customer database can help you to manage your customer relations effectively.

NetSuite Accounts Receivable Benefits:

- Sharpen your understanding of your financial position.

- Make smarter business decisions.

- Gain a clear view of your current and projected cash positions.

- Improve your customer credit management.

- Ensure data accuracy.

- Save time by avoiding the process of deciphering overdue payments and interest charges.

NetSuite Electronic Payments

NetSuite Electronic Payments Features:

Electronic Payments for Electric Payoffs

Make it easier for customers to do business with you by accepting a variety of payment options. Make it easier for your company to manage finances. Simplify your operations with a single system and single set of records for all payment processing.

NetSuite’s platform offers several payment processing options to capture funds and disburse payments. Easily connect your accounts receivable and accounts payable processes with third-party payment systems, processors, and financial institutions to collect funds and make payments. NetSuite handles processing activities including invoice payments from accounts payable, settlements against credit card accounts and bank accounts for accounts receivable, and bank account transfers. This automation and consistency streamlines your business. In turn, you’ll notice your payments are made on time efficiently and your books are always accurate, updated in real time.

- EFT (Electronic Funds Transfer)

Allow customers to authorize the transfer of funds from their bank accounts to your bank accounts to pay their invoices for simplified payment processing. - Customer Credit Card Processing

CNetSuite’s end-to-end credit card processing efficiently handles credit card payments for both sales orders and website orders. - Online Bill Pay

Make payments without manually printing, signing, and sending checks. - Google Checkout

Use Google Checkout to capture funds when processing orders from your webstore. Offering Google Checkout is offering a simple payment method to your customers. - Direct Deposit for Payroll

Use the direct deposit feature to disburse payroll funds directly to employees’ bank accounts. - PayPal Express Checkout

Make PayPal an option for your customers. Use PayPal Express Checkout to capture funds if you process orders from a webstore. - Electronic Payments

NetSuite Electronic Payments is freely available to all NetSuite customers. This module provides electronic banking functionality including ACH, EFT payments, direct debit collections, check fraud prevention with Positive Pay, and more. - ACH Processing

ACH (Automated Clearing House) smoothly processes financial transactions through the ACH Network for fast, reliable funds capture and disbursement.

NetSuite Electronic Payments Benefits:

INTEGRATED. CUSTOMIZABLE. EASY. WALLET FRIENDLY. GREEN.

- Unlock productivity by streamlining order-to-cash and cash-to-reconciliation processes.

- Simplify your financial operations with a single system and a single set of records for all payment processing (web order, phone order, cash sale, or invoice payment).

- Set up payment processing across multiple organizations, regions, and currencies.

- Improve cash flow and shorten time to payment with cost-effective credit card, business card, and purchasing card acceptance.

- Capture funds for web orders as payment processing integrates with your website.

- Make it easier for customers to do business with you by accepting a variety of payment options.

NetSuite General Ledger

NetSuite General Ledger Features Can:

Transform Rigid, Static GL into Flexible, Workable Opportunity

NetSuite ERP includes SuiteGL, a cloud-based general ledger that outperforms your typical one-size-fits- all GL. NetSuite General Ledger gives finance departments more flexibility in their accounting software with new customization features.

Be more dynamic. Tailor financials to the way YOU do business. Gain company-wide insight with next-generation accounting.

Custom GL segments: no limits.

- Ensure that GL financial impact follows double-entry accounting principles and balances across all segment combinations.

- In addition to reportable segments (department, class, location), add region, territory, division, product line, item family, and channel.

Custom transaction types: designed uniquely.

- Easily design transaction types tailored to your company or industry.

- Define entirely new business processes with your own approval process and routing, discrete audit trail, permission controls, and type-specific transaction numbering.

Custom GL lines: no manual labor

- Automatically attach additional general ledger impact lines to existing processes such as sales, invoicing, or vendor bills.

- Add custom GL impact lines to standard transactions across single or multiple accounting books.

NetSuite General Ledger Benefits:

- Improve GL accuracy and save time.

- Generate more effective reporting and analytics

- Eliminate manual entries and errors.

- Simplify business transactions with other countries.

- Measure performance at a more finite level.

NetSuite Competitive Switch

NetSuite Competitive Switch Benefits:

Move Beyond Point Packages to a Complete Solution

Support your entire company— accounting, sales, fulfillment, service, and more — while eliminating the transfer and re-keying of data between multiple applications.

Software packages like QuickBooks solve limited issues and leave you with multiple islands of data and expensive integration projects that never work. Information has to be manually re-entered or batched into other applications, wasting both time and money. NetSuite takes the burden off your growing organization by providing a comprehensive solution that lets you focus on running your business.

NetSuite Competitive Switch Features

Are QuickBooks & Peachtree too limited for your business?

- World-class cloud infrastructure.

- Reliable, fault-tolerant, built-in disaster recovery.

- Security against hacking and data theft.

- Simple yet powerful management of user-access restrictions and audit trail.

- No practical limits of user count, volumes, or performance.

- High levels of customizability without writing code.

- Customized workflow and ability to add unlimited files and fields.

- Personalized dashboards and easily customizable reporting.

A 360-degree view from a unified platform vs. separate views and versions from stand-alone applications.

- NetSuite provides deep integration of data and business functions. Unlike stand-alone software, NetSuite CRM reaches deep into the transaction engine of NetSuite.

- Many companies fail to make the vital link between marketing campaigns and sales execution. NetSuite’s marketing automation software bridges that gap. What about sales to service? And the entire cycle of lead to cash, order to fulfillment, etc?

- Old data, unverifiable data, multiple versions of the truth? These are issues companies face when they’re lacking a unified, complete view of their business performance and true, consistent insight into organizational health.

NetSuite Order Processing & Fulfillment

NetSuite Order Processing & Fulfillment Features:

Expedite & Simplify Your Order-Fulfillment Cycles

NetSuite expedites your order-to-cash process by eliminating manual bottlenecks and errors and establishing a smooth flow from sales quote to approved order, order to fulfillment, and invoicing to payment. NetSuite Order Processing integrates your sales, finance, and fulfillment teams, thereby improving quote accuracy, eliminating billing errors, strengthening revenue recognition processes, and driving fulfillment accuracy and efficiency.

- Automatic integration with shipping, billing and invoicing, A/R, inventory, and more.

- Out-of-the-box shipping integration.

- Highly visual analytics and reporting.

- Dashboard alerts and exception reporting.

- Real-time order tracking and visibility.

- Automatic shipping-label generation.

NetSuite Order Processing & Fulfillment Benefits:

- Save time and money by easily customizing shipments and automatizing bulk fulfillment processes.

- Optimize customer interaction by customizing order forms by class of user.

- Increase customer satisfaction with simple self-service tracking tools available 24×7.

- Bypass manual data exchange among order management, shipping, and customer service.

- Link tracking numbers with sales orders, invoices, and customer records for enhanced visibility.

- Improve efficiency with one-click electronic routing integration with FedEx® and UPS®.

NetSuite Financial Management: A Deeper Dive into NetSuite | Learn how to leverage NetSuite's preconfigured financial reporting to efficiently manage your business's financial statements. Learn how to leverage industry-leading practices and gain valuable insights for streamlined financial management.

Transform Your Business With NetSuite Cloud Financial Software

Ready to enhance your business with NetSuite Cloud Financial Software? Unlock streamlined operations, enhanced financial visibility, integrated business processes, scalability, business intelligence, compliance, and mobility. Take the next step towards success and schedule a demo or contact our sales team today. Discover how NetSuite can revolutionize your financial management and drive your business forward.

Protelo's NetSuite experts help businesses select, tailor, and implement software to run their organization on one, integrated, cloud-based platform. Have Questions? Would you like a free trial or a demo? To learn more contact our team of NetSuite experts today! We are here to make your business even better.

Receive Updates

On LinkedIn

Request More Information

This site is protected by reCAPTCHA and the Google

Privacy Policy and

Terms of Service apply.